(Original title: An article to understand Nvidia's automated driving solutions)

Editor's note: This article is from GeekCar, author Mark;

At Keynote Hall at the Convention Center in San Jose, Silicon Valley, USA, I witnessed the sponsor throwing out a new generation of "Volta" architecture GPU "nuclear warheads" products and announced cooperation with Toyota. This conference directly caused NVIDIA's stock price to soar by 18%. So what is the layout of NVIDIA's automated driving solution driven by the new architecture? How did they cooperate with OEMs and Tier 1? At the GTC site, we interviewed Danny Shapiro, senior director of NVIDIA Automotive Division. This article will use his dissertation to dissect NVIDIA's layout in the automotive industry.

NVIDIA's Autopilot Platform

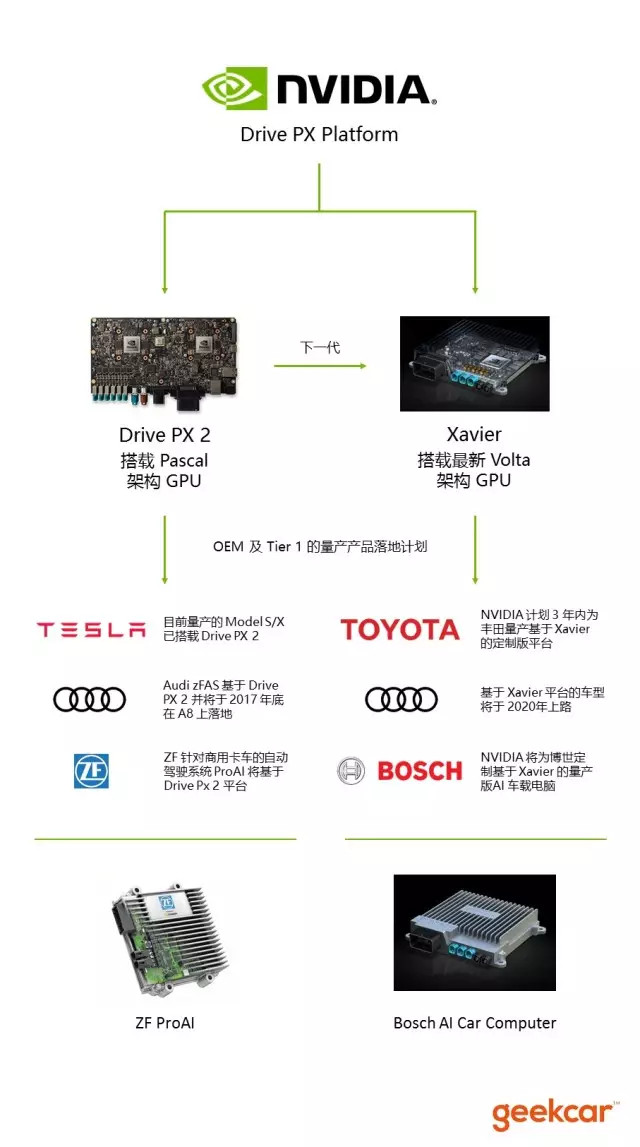

When we talk about NVIDIA's autopilot solution, we think of the Drive PX series. But in fact, Drive PX is just a series name of NVIDIA car AI platform. This series currently includes two generations of products: the Drive PX 2 platform, which has already been mass-produced, and Xavier, a next-generation platform that has been released but will be first produced at the end of this year. We have made a map to reflect the relationship between the two platforms, and the current vehicle manufacturer cooperation information based on these two platforms:

Specifically, two generations of platforms have the following differences:

Drive PX 2: Equipped with a previous-generation Pascal architecture GPU. Mass production has already been achieved and is already available on Tesla's production models Model S and Model X. Currently, the PX 2 is still the main force of the NVIDIA automatic driving platform in the market, and most of the tested vehicles using the NVIDIA solution (whether from vehicle manufacturers, Tier 1, technology companies, or universities, etc.) are basically equipped with Both are Drive PX 2. Tesla, Audi and ZF are the only companies to announce the use of the Drive PX 2 in production vehicles.

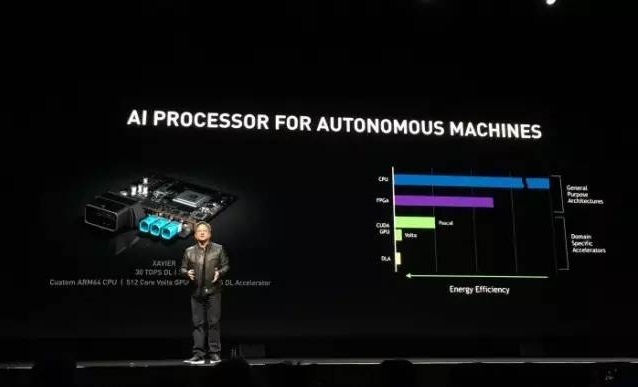

Xavier: It can be said that the evolution of the Drive PX 2 with the latest generation of Volta architecture GPUs, Xavier performance will nearly double compared to the Drive PX 2, equipped with the previous generation of Pascal architecture GPU.

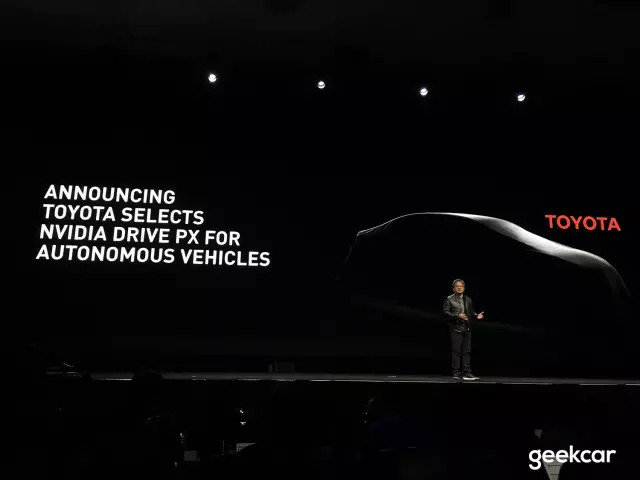

However, this SoC won't be ready until the end of this year. This brings about a very important time-matching point: Relieve the abuse of the mother's family, stumbling on the wrong side of the market, and raise the number of people involved in the crime. After 020 years, if this time is deducted from the development of the vehicle Cycle time (generally about 3 years for a mature platform), then Xavier's mass production will just catch up with the development process of this self-driving car. This explains why Xavier's cooperation is based on a production vehicle production plan. Including the Toyota cooperation announced by the GTC, this is no exception.

Whether it is Toyota, Audi or Bosch, they all hope that through this cooperation, their own production programs can use NVIDIA's current best autopilot platform. So for NVIDIA, Xavier is the platform that is really used to enter the depot production.

How will NVIDIA and car companies cooperate in the future?

How will NVIDIA and car companies cooperate in the future?

On this issue, I talked with Danny carefully. We will explain in several points:

1. NVIDIA's positioning in the automotive supply chain: Danny told me that NVIDIA's positioning is mainly in the automotive industry to provide the computing platform needed for all aspects of automated driving. Although they themselves have test cars such as BB8, their purpose is more to demonstrate the capabilities of the NVIDIA computing platform and not to collect driving data to develop their own driving decisions.

2. What is the difference between OEMs and Tier 1? For NVIDIA, the cooperation between the two is to provide a computing platform. After selecting an NVIDIA computing platform, OEMs will look for a Tier 1 product. Tier 1 chose NVIDIA's platform and will push this solution to more OEMs.

3.Participants of Laos and Huangye Tier 1 provides a differentiated platform: Xavier's underlying architecture is unified, but based on this architecture, NVIDIA will provide customized versions of Xavier based on the sensor layout and requirements of different vendors. Computing platforms, such as those previously released by Bosch on BCW, are NVIDIA's customized versions.

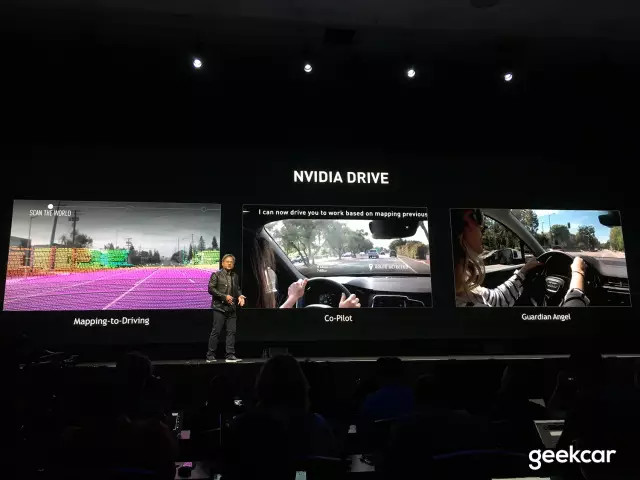

In addition, on the Xavier computing platform, various vendors can add their own algorithms and further develop different functions through the DriveWorks SDK. For example, NVIDIA's previously announced AI Hot-Pilot at CES will be an optional development module for the Xavier platform. The depot can develop sensors based on its own needs to develop corresponding functions, including map acquisition, face recognition, lip language recognition, and voice driving assistance.

In addition, on the Xavier computing platform, various vendors can add their own algorithms and further develop different functions through the DriveWorks SDK. For example, NVIDIA's previously announced AI Hot-Pilot at CES will be an optional development module for the Xavier platform. The depot can develop sensors based on its own needs to develop corresponding functions, including map acquisition, face recognition, lip language recognition, and voice driving assistance.

4. Kwong Comfort OEM integrates solutions from different vendors: The zFAS system integrates NVIDIA's SoC and Mobileye's EyeQ chip. In this regard, Danny's view is that vehicle manufacturers have the right to freely choose and combine the solutions they want to use. But at the time when Audi began developing zFAS, NVIDIA's computing platform was not as strong as it is now. If you use NVIDIA's latest platform to measure, in theory, there is no need to separately integrate the visual processing chip.

We can feel that NVIDIA, the fastest-growing technology company in the AI ​​era, is making great strides in developing the automotive business and has quickly won the favor of many OEMs and Tier 1s. However, in the maintenance of car-client customer relationships and the positioning of the supply chain, they maintain a standard auto supplier attitude: they rely on the strength of their computing platform to gain more market share, while leaving space for OEMs and Tier 1 Adequate choice and premium space.

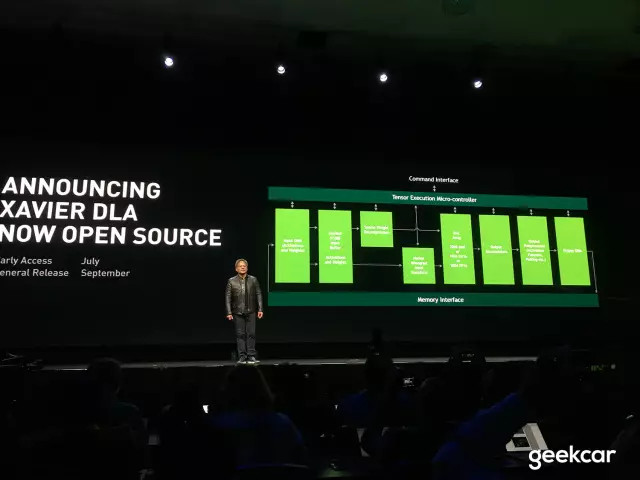

At this conference, Lao Huang also announced the open source of the DLA on the Xavier platform. This also means that NVIDIA leaves room for other vendors to develop. After all, for the automotive industry, a mono-vendor monopolizing a certain technology is unwilling to see any OEM.

For the first batch of carmakers that have reached cooperation with NVIDIA, the advantages they can get will be as follows:

1. Be the first to test NVIDIA's latest computing platform first: Know that the Xavier platform was announced as early as last year's GTC Europe, but its true mass production has to wait until the end of this year. In the year and more before the mass production, NVIDIA will surely find a group of closely-related carmakers to test the new platform first, and these depots that get the “early bird ticket†will naturally accumulate in the R&D and application of the Xavier platform. More experience and advantages. I would like to run a custom Xavier test that has already got several DEMO versions of Bosch now.

2. Can get higher supply priority after mass production of NVIDIA computing platform: As the AI ​​developer's "standard", the flagship GPU SoC can be said to be "a hard-to-find card" in this era. After the Xavier platform is mass-produced, it is likely that the demand for auto-driving will fall short of supply. Will the car companies that have partnered with NVIDIA gain more priority at this time?

3. Can get more customizable space: In the early days, Xavier's platform is likely to have a lot of immature places, then the earliest depots involved in joint R&D will naturally have more opportunities and space to participate in Xavier. In the optimization, and put their needs into the final platform.

The open cloud is the future of NVIDIA

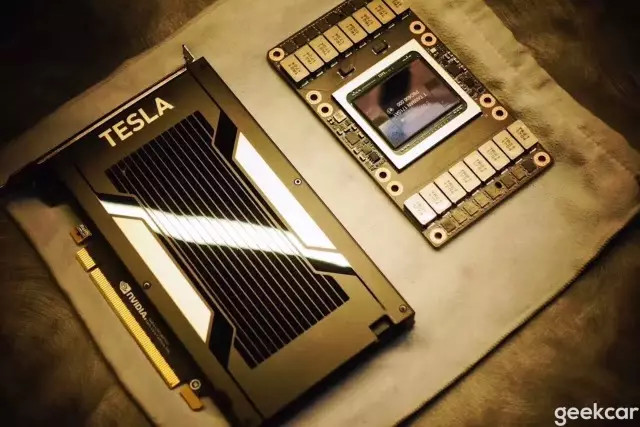

In fact, in addition to the Xavier platform, Lao Huang’s GTC conference will focus on the NVIDIA Tesla V100 GPU, a data computing center based on Volta architecture, and DGX-1, a cloud server product powered by Tesla V100. These products are actually used in the cloud data center for deep learning operations. It is said that the computing power of a DGX-1 is equivalent to 800 CPUs.

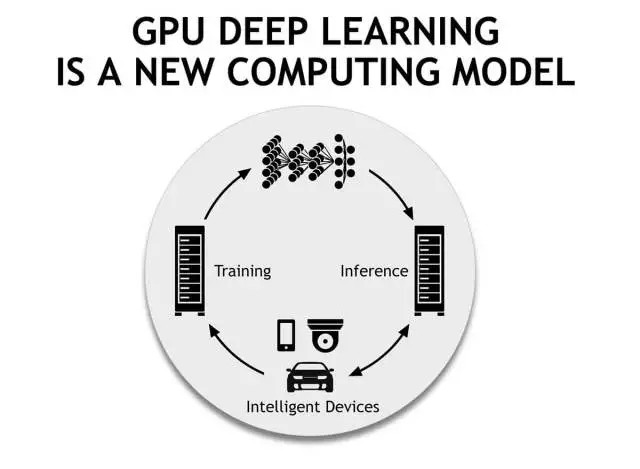

So what's the relationship between this server computing chip and the auto industry and autopilot? The Xavier Xavier is a terminal computing platform built on a car and is mainly responsible for passing sensors. The data-aware surrounding environment is located in real-time using high-precision maps, and driving decisions are made according to the algorithm model.

In the cloud, you need a data center with super data processing capabilities. All vehicles connected to the cloud will upload their own driving data here. The task of the cloud is to use these large amounts of data to train decision-making and perceptual algorithms in the form of deep learning or enhanced learning. The training-optimized algorithm model will be re-updated to each vehicle terminal after stability verification. This is the Self-Healing System used in future autonomous driving.  Under this system, depots must establish their own cloud servers because they need to keep their driving data in their hands as much as possible (driving data is a core competency). This brings more potential demand for NVIDIA products. The cloud is the place that can truly reflect the computing power of the NVIDIA platform.

Under this system, depots must establish their own cloud servers because they need to keep their driving data in their hands as much as possible (driving data is a core competency). This brings more potential demand for NVIDIA products. The cloud is the place that can truly reflect the computing power of the NVIDIA platform.  Write here, I want to say: Can anyone help me get a Drive PX 2 to play? If not, come to Titan Xp!

Write here, I want to say: Can anyone help me get a Drive PX 2 to play? If not, come to Titan Xp!

燑br>

燑br>

6-10HP Compressor Series Sealed Terminal Blocks

6-10Hp Compressor Series Sealed Terminal Blocks,D Type Terminal For Compressor,Three-Phase Seal Terminal For Home Appliance,Air Conditioner Compressor Terminals With Rubber

Shenzhen Capitol Micro-Electronics Co.,LTD , https://www.capitolgtms.com