According to the Wall Street Journal, former NBA star Kobe Bryant announced today the establishment of a $100 million venture capital fund with a focus on technology and media companies. Among them, the partners who set up this venture capital fund are senior entrepreneurs and investors Jeff Stibel.

Kobe and Stebb's company is named Bryant Stibel and headquartered in Los Angeles. Since 2013, the two have invested in 15 companies, including ThePlayers Tribune, a sports media site, Scopely, a video game publisher, LegalZoom, a legal services company, RingDNA, a telemarketing software company, and Juicero, a homegrown juicer manufacturer. Until Kobe Bryant retired, the two sides formally established a cooperative relationship and jointly established this venture capital fund.

After retiring Bryant began to devote his full energies to the investment business. As early as the player's time, Kobe had already emerged in the investment circle. According to sources, in 2013 Kobe registered Kobe.Inc, which is mainly responsible for outbound investment and business activities. His first investment project was BodyArmor, a new sports drink, and Kobe had over 10% of the stock.

In addition to Kobe Bryant, there are no shortage of other players who have demonstrated their talents in the VC circle and achieved good results.

O'Neal

O'Neill once publicly claimed that he was the world's top geek in the southwest southwest United States Congress. O'Connell’s most successful case was to invest in Google in the early stages and received a lot of returns on its IPO. After he retired, he brought talents to Silicon Valley to enter the investment field . The investment scope covered Internet finance and mobile video services. Previously, O'Neill also served as a consultant for mobile video company Tout, whose main competitor was Vine, a short video service provider owned by Twitter.

In the middle of last year, O'Neill became an investor in Loyal3 , an internet financial services start-up company. Some of Loyal3’s businesses underwrite other companies’ listings. Through cooperation with investment banks, certain underwriting commissions are obtained. So far, Loyal3 has participated in the IPO underwriting and subsequent issuance of more than a dozen companies, including GoPro, a renowned sports camera manufacturer, and AMC Entertainment, the second largest cinema line in the United States.

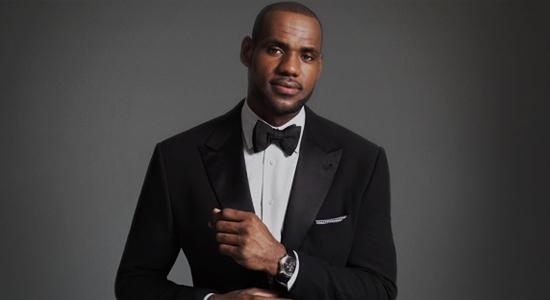

James

In 2007, James embraced Warren Warren Buffett's thigh. Buffett helped James develop his LRMR Marketing company. Under Buffett's guidance, James bought a share of high-end headset Beats by Dre. Eventually Apple acquired Beats by Dre for $3 billion, and James earned $30 million from it. Buffett’s advice to James is “invest in projects you are familiar with and never step into areas you are not familiar with.â€

Jordan

The most profitable retired star is undoubtedly Joe. Regardless of the value brought by AJ, he had jointly invested $44 million with Mavericks owner Cuban to invest in Sportradar, a sports big data company. The product of Sportradar determines the physical performance of players by collecting the data of each player. If the amount of exercise is overloaded. In addition, it can help players optimize scoring and defensive efficiency. It is reported that many defending champions teams have adopted the company's data analysis services. As the boss of the Charlotte Hornets (formerly the Bobcats), after Jordan invested in Sportradar, the team's record has also improved.

Anthony

In 2014, Anthony and NBC Television's former executive Stuart Good Fabre together invested in the establishment of the venture capital company M7. M7 stands for "Melo 7". M7's first investment project was Hullabalu, a children's media company. In addition, M7 continuously followed A and B rounds of smart dog collar company Whistle. The company's products can help owners monitor the dog's physiological state in real time. Currently Whistle has been acquired by Mars Petcare, and Anthony's investment has also successfully withdrawn in return.

In an interview, Anthony mentioned that “since I remembered, I’ve been interested in technology. I’ve been looking for good VC projects, hoping that they can develop products with advanced meaning and be able to quickly become a consumer group. Open the market. I have always been very interested in wearable devices and internet technology, and I think that represents our future direction."

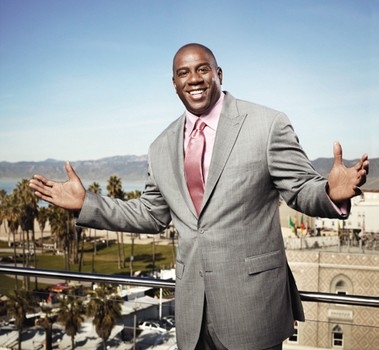

Magic Johnson

The Lakers named Johnson Johnson founded the Magic Johnson Investment Company in 1995. The investment scope is mainly focused on the Internet, theaters, and advertising. He also joined the Detroit Angels Investment Group in 2011. His investment projects include Stylecaster, a fashion matching website, Sociocast, a big data market forecasting service, and FLUD News, a news reading platform. Last year, he will become the eighth member of the board of directors of the well-known American mobile payment company Square, but will resign from the position of director in the middle of this year.

At the same time, Magic Johnson also put some of his investment in projects that can help the disadvantaged. Jopwell is a vertical recruitment platform he invests in to help those ethnic minorities in the United States who are not respected to find jobs.

other"Admiral" David Robinson founded the Admiral Capital Group with friends and the investment amount was between 15 million and 100 million U.S. dollars. Robinson's participation includes the B2B online learning platform Trive15, which focuses on entrepreneurship.

Nash had established his own fund investment consulting firm Bullish, invested in the electronic business platform Birchbox, the United States glasses electricity supplier Warby Parker and the free writing platform Contently, Kiwi Creat and so on.

Andre Iguodala of the Warriors once invested in Twice, the second-hand online trading market, and the company was acquired by eBay.

Balang Davis participated in the investment of the O2O project BloomThat, which graduated from the well-known American incubator YC.

Howard invested in a project called Tapiture, which allows users to discover and share their favorite content. The company is currently acquired by PlayBoy.

Of course, there are also many people who have failed in investment. Among them, Scott Pippen, Iverson, and Anthony Walker all made substantial losses in their investments. At the same time, many players in the investment community are not willing to cooperate with the stars because many of the players have become more lenient after entering the investment field .

It is reported that Kobe had studied investment with Uber and Twitter investor Saka a few years ago, but Saka does not seem to want to see Kobe. Saka mentioned that he initially questioned Kobe because most professional athletes regard business as a play and try to avoid it. However, Saka later discovered that Kobe’s enthusiasm for learning entrepreneurial knowledge is no less than his obsession with basketball, which greatly admired Saka. This is why many investors are willing to cooperate with Kobe Bryant.

At present, there are more and more examples of blood supplements between the basketball and science and technology circles. Marc Cuban, the famous technology circle boss, has been managing the Mavericks for many years, while former Microsoft CEO Ballmer and co-founder Paul Allen are the Clippers and Portland Trail Blazers boss. These Silicon Valley giants not only brought capital to the NBA, but also made great contributions to the high-tech development of the alliance, making sports wearables, big data, cloud computing, VR and other products widely used in the game. The players affected by science and technology products have also shifted their investment direction from traditional industries such as real estate and catering to high-tech fields, and have contributed to the development of a large number of outstanding technology companies, especially sports technology companies.

Related Reading

Did I get it wrong, NBA star will hold the first science and technology summit?

NBA star Antony founded science and technology investment company

Tinned Copper Clad Copper TCCC

Corrosion-Resistant Copper-Clad Tinned Wire,Copper-Clad Copper Tinned Wire Production,Copper-Clad Copper Tinned Wire Processing,Copper-Clad Tinned Wire

changzhou yuzisenhan electronic co.,ltd , https://www.yzshelectronics.com